|

|

|

|

|

|

|

|

|

|||

|

|

|

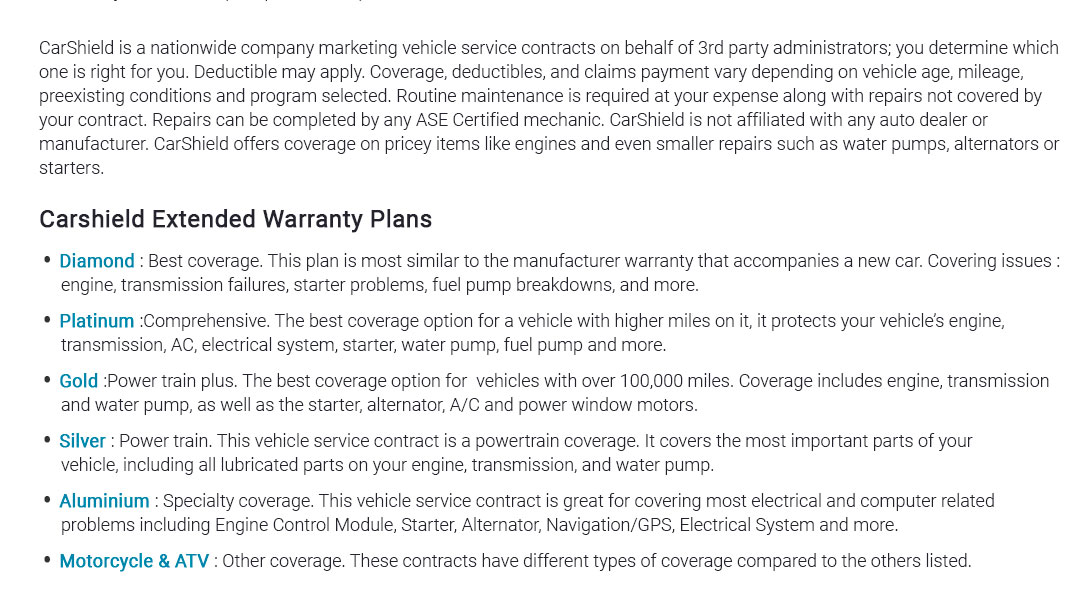

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

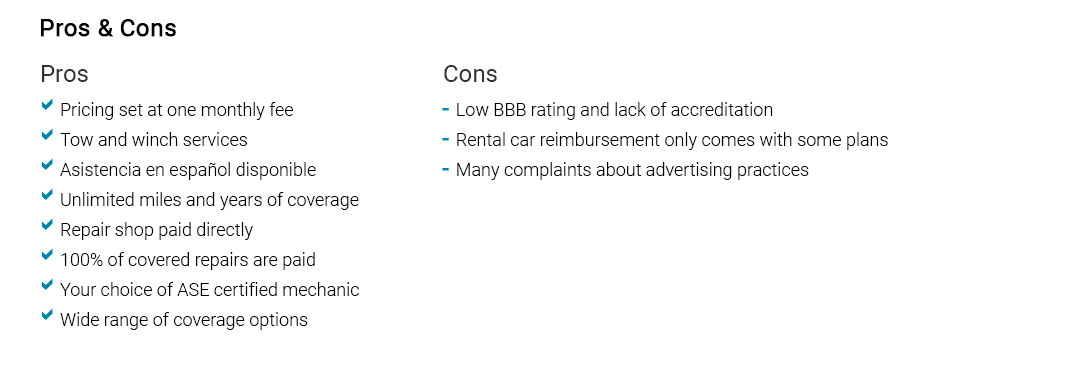

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

car insurance near me: a priority-first guideLocal policies live and die by three factors: state rules, your daily routes, and claim response times. Decide what matters now

Compare like a pro

Reality checkA driver refreshes a quote on a phone in a grocery lot after a minor fender-bender; the fastest answer wins the day. Pause. Rates shift every renewal; the math is impersonal, the impact isn't. Coverage shortcuts that backfire

Explore options if service, limits, and turnaround beat your current result; otherwise, stay. https://www.mercuryinsurance.com/local/new-york/auto-insurance/

My previous insurance company raised my rate by over $100 without notifying me ... https://www.libertymutual.com/vehicle/auto-insurance/state/new-york

Need car insurance in New York? We'll help you find the right NY auto coverage and discounts to help you save. Get a free online quote in less than 10 ... https://www.thezebra.com/auto-insurance/new-york-car-insurance/new-york-ny-car-insurance/

The cost of auto insurance in New York is around $2,273 for a six-month policy or $379 per month on average. As per our 2023 data, National Grange Mutual is the ...

|